Challenges in Implementing AI and Chatbots for Customer Support

CSM Magazine

JANUARY 15, 2025

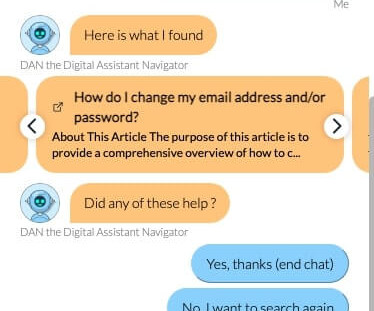

While no one can truly comprehend the extent of the impact it will have, there is no doubt that AI and chatbots for customer support are being embraced by more and more companies. It can be a huge help, improve customer satisfaction and engagement, and enable you to work through questions faster and more efficiently.

Let's personalize your content